With each new administration comes uncertainty, especially when evaluating campaign promises that could potentially impact your privately owned business. One promise that has been top of mind for many individuals and privately held companies is the new administration’s call for reforms to capital gains taxes.

Shareholders of privately owned companies should be asking themselves several key questions:

- How do capital gains taxes influence my company?

- What would a capital gains tax increase mean for my business?

- How do I best prepare my business for the future?

In this article, we explore the capital gains tax, how future increases would impact privately held businesses, and how to best prepare your business for uncertain times.

Generally speaking, how do capital gains taxes influence privately owned companies?

Nearly a century ago, the United States Revenue Act of 1921 separated long-term capital gains from income tax in an effort to stimulate the US economy following World War I[1]. This separation allows private citizens to sell real property, privately owned businesses, and investments without implications to their income tax bracket. Similarly, LLCs and S-Corporations can leverage lower long-term capital gains rates when executing a sale or liquidity transaction. These liquidity events can vary as owners aren’t always selling their entire business and may pursue a partial sale to maintain some ongoing ownership.

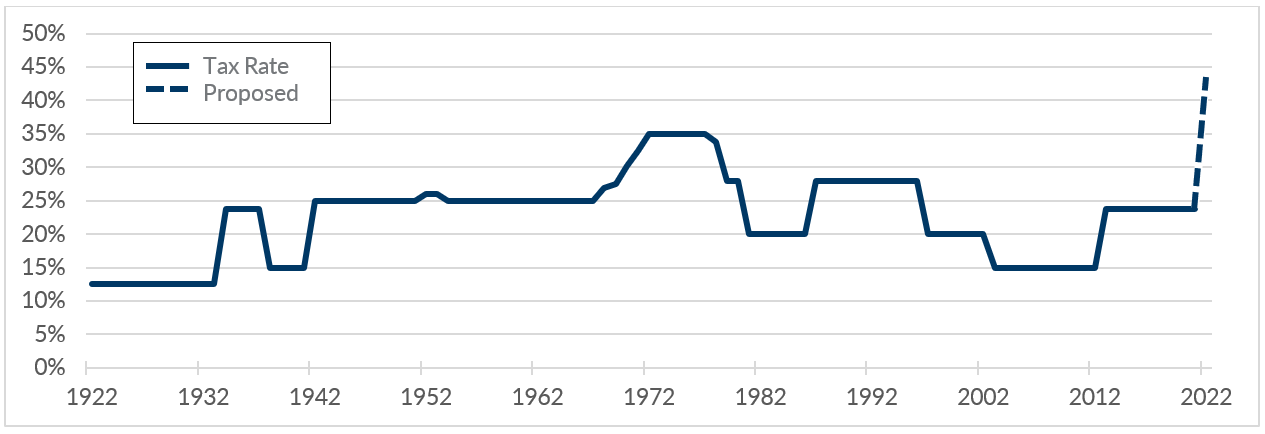

Capital Gains Tax[2]

The Biden administration has communicated a desire to increase capital gains rates by over 80% for taxpayers whose income exceeds $1,000,000; this would push the highest rate from 23.8% to 43.4%, including the net investment income tax (NIIT). If enacted, this increase would set a record for capital gains taxes, well exceeding prior highs. This change would meet the current administration’s objective to align the capital gains tax closer to the individual income tax for those in higher tax brackets.

What does the capital gains tax increase mean for my privately owned business?

As announced, “The American Families Plan” would be funded by tax code reforms on individuals earning more than $400,000 annually. The proposed tax rate of 43.4% would reduce net proceeds in a sale transaction by as much as 20%. Companies seeking a liquidity event in the next few years should consider acting more quickly to lower their risk of being taxed at this new rate. While the timing remains uncertain, there is a sense of urgency to pass the legislation before the 2022 mid-term elections. If the bill cannot achieve bipartisan support, there is still a path forward to pass it in 2021 with a simple majority through a budget reconciliation process.

From an M&A perspective, now is a great time to assess whether or not it makes sense to go to market. Not only due to the potential change in capital gains rate, but also because current market conditions are very favorable to most sellers. Factors driving the seller’s market include:

- A strong stock market

- Buyer optimism around the continued vaccine rollouts

- Historically low interest rates

- Significant debt availability

Company valuations across multiple industries are approaching all-time highs in part because many acquirers, both strategic and financial, are flush with large cash balances.

How do I best prepare my business for the future?

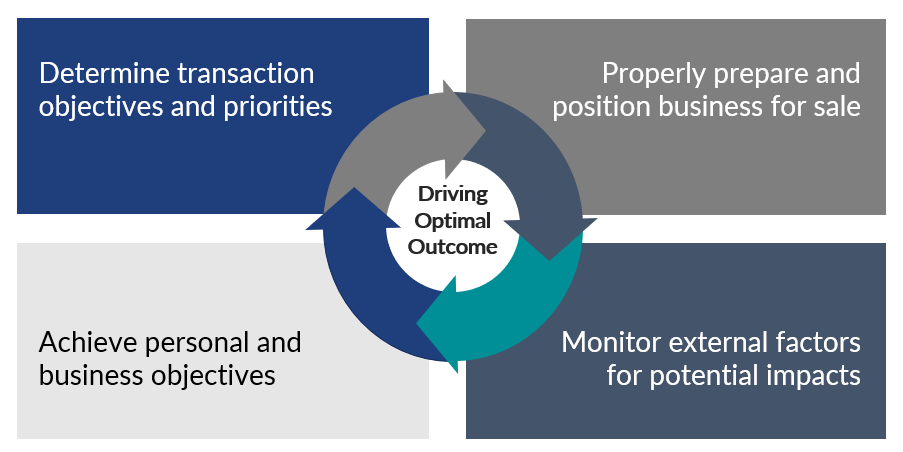

As a private business owner, there are many variables at play when assessing the right time for a transaction. Understanding your liquidity objectives along with a detailed review of your business is key to being prepared regardless of market conditions. This detailed business review should cover a company’s operations, organizational structure, strategic plans, and product, customer, and financial profiles.

PMCF’s Readiness Review helps private business owners through this rigorous task, ensuring a holistic approach to driving an optimal outcome to their transaction, including planning for multiple tax rate environments. In coordination with your tax advisors, we calculate the after-tax proceeds to shareholders under various scenarios for the company. We also take into consideration the macroenvironment surrounding your business, which includes the broader economy and industry. Our objective is to develop a tailored transaction plan with results-driven solutions to maximize your business value while minimizing potential surprises. Understanding your business’ current value, as well as forecasting future scenario plans, will help you know if you should weather the proposed tax increase or expedite a sale ahead of it.

Conclusion

The proposed capital gains tax increase is an important financial issue privately held companies should thoroughly evaluate this year, especially if you are currently considering a potential liquidity event. When thinking about how this change could affect your business, be sure to plan for multiple scenarios to make sure you take action when the timing is right. If you are a privately owned business looking to understand your options in these unknown times, contact us to learn how we can help.

[1] https://www.loc.gov/law/help/statutes-at-large/67th-congress/Session%201/c67s1ch136.pdf

[2] Congressional Research Service, IRS